The Power of Flexible Payment Plans in B2B SaaS

Revolutionizing SaaS with Flexible Payment Solutions

In the burgeoning world of B2B SaaS, the financial landscape is experiencing a radical transformation. The advent of flexible payment plans, particularly Buy Now, Pay Later (BNPL) models, is redefining how SaaS companies approach growth and cash flow management. This innovation is particularly significant for venture capitalists and financial analysts who are on the lookout for cutting-edge finance strategies in the tech sector.

The Evolution of Financing in B2B SaaS

Gone are the days when equity and traditional debt were the only pillars of startup financing. Today, B2B SaaS companies are increasingly turning towards more agile and founder-friendly models like BNPL and Revenue-Based Financing (RBF). These models align seamlessly with the recurring revenue streams characteristic of SaaS businesses, offering a more sustainable route to capital without the high costs typically associated with equity financing.

Case Study: Webscale's Success with Flexible Financing

Sonal Puri, Board Member and former CEO of Webscale, encapsulates the essence of this shift: “Every SaaS company should partner with Ratio because it’s a true win-win situation – our customers get the terms and flexibility they need and we get the cash upfront without dilution and zero risk.” This statement underscores how flexible payment plans can create mutually beneficial scenarios for both providers and clients in the B2B SaaS arena.

Leveraging RBF for Growth and Stability

Revenue-Based Financing stands out as a beacon of innovation in SaaS growth financing. This model’s alignment with revenue cycles offers unprecedented flexibility during fluctuating sales periods. Its non-dilutive nature is a boon for founders who wish to retain full ownership of their ventures.

Ratio Tech's Pioneering Role in Flexible Financing

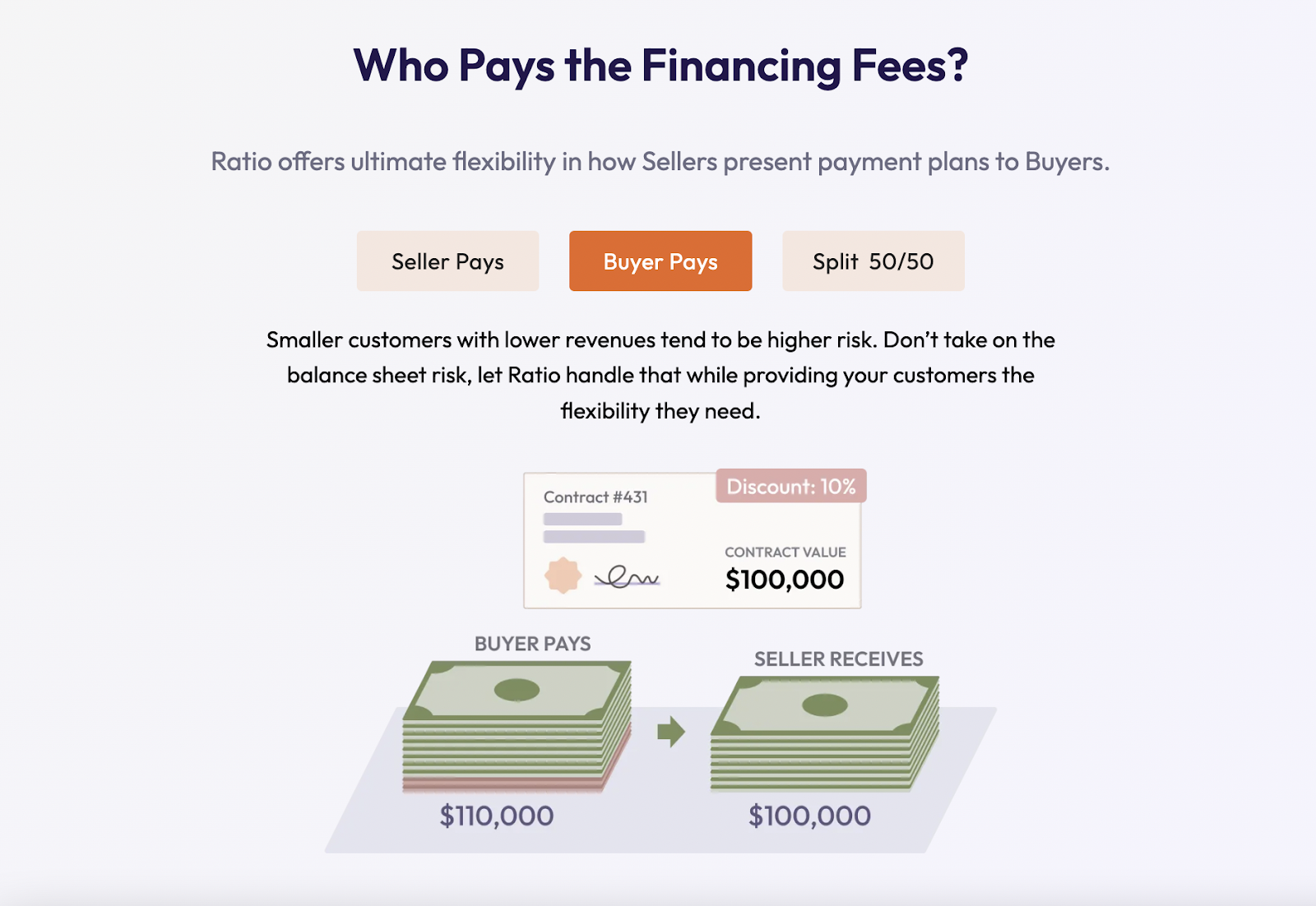

Ratio Tech emerges as a trailblazer in this financial renaissance. They offer tailored RBF solutions that resonate with the unique needs of B2B SaaS companies. Their customer-centric approach, highlighted by Tom Rilley, Board Member at Talk Desk, offers a competitive advantage through flexible payment options. Ratio Tech's strategies enable SaaS companies to manage their cash flows efficiently while fostering robust growth.

Unique Offerings of Ratio Tech Compared to Other BNPL Vendors

What sets Ratio Tech apart in the BNPL space is their deep understanding of the SaaS business model and their commitment to providing tailored solutions. As detailed in their Tech Leader's Guide to B2B Payment Flexibility, Ratio Tech emphasizes the importance of aligning payment terms with customer needs, thus enhancing customer satisfaction and loyalty. Their innovative approach, as seen in their collaboration with U.S.-based recurring revenue financing partners, is a testament to their leadership in providing flexible and efficient financial solutions tailored to the SaaS industry.

Impact on Cash Flow and Business Growth

Flexible payment plans, as offered by Ratio Tech, revolutionize cash flow management for SaaS companies. These plans allow businesses to accelerate growth without the constraints of traditional financing models. By adopting Ratio Tech's innovative solutions, SaaS companies can venture into new markets, invest in product development, and scale operations while maintaining financial health.

The Future of SaaS Financing: A Forecast

As the SaaS industry continues to expand, the demand for flexible and innovative financing solutions will surge. Revenue-based financing and BNPL models, championed by forward-thinking companies like Ratio Tech, are poised to become mainstays in SaaS financing. These models offer a sustainable pathway for SaaS companies to thrive in competitive markets and scale efficiently.

Charting a New Course in SaaS Financing

For venture capitalists, analysts, and SaaS companies alike, embracing flexible payment plans like those offered by Ratio Tech represents an opportunity to redefine growth strategies. Exploring these innovative financing options allows SaaS businesses to navigate their financial journeys with greater agility and confidence.

To delve deeper into how Ratio Tech is reshaping SaaS financing and to explore their unique

offerings, visit their website and blog. Discover the unparalleled advantages of their BNPL and RBF solutions, and how they are setting new benchmarks in the B2B SaaS financial landscape.

Revolutionizing SaaS with Flexible Payment Solutions In the burgeoning world of B2B SaaS, the financial landscape is experiencing a radical transformation. The advent of flexible payment plans, particularly Buy Now, Pay Later (BNPL) models, is redefining how SaaS companies approach growth and cash flow management. This innovation is particularly significant for venture capitalists and financial…

Recent Posts

- Boston Roofing Co. Sets the Standard for Quality Roofing Services in the City

- Relief Recovery Center Offers Holistic Healing through Yoga, Meditation, and Wellness Programs for Addiction Recovery

- The Law Office Of Kevin R. Garbe, PLLC: Your Trusted Long Island Real Estate and Estate Planning Attorney

- Modern Laundry: Your Go-To Laundromat in Windsor, CT, Offering Exceptional Laundry Services

- Transform Your Space with Bathroom Remodel Rochester – Your Premier Bath Fitter in Rochester, NY